Respondent with Children

California Divorce Form FL-140

FL-140 is served on your spouse, but not filed with the court.

The Declaration of Disclosure is form FL-140, and aside from ensuring the correct boxes are checked and the required documents are attached, there isn’t much else to this form.

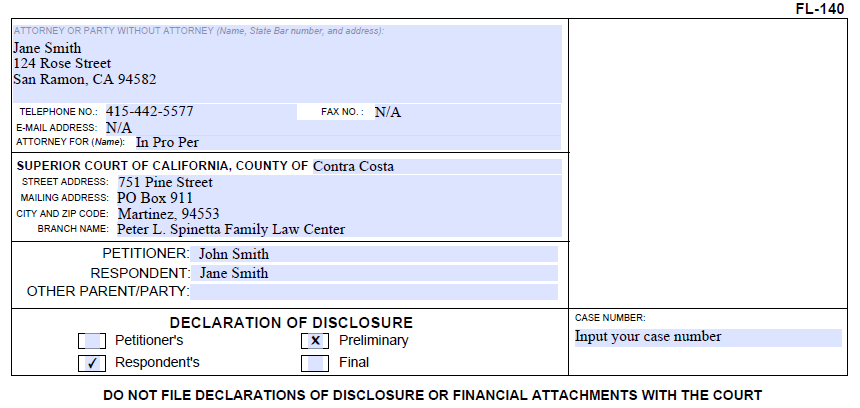

FL-140: Contact and Court Information

We’ll assume this is your preliminary submission, as is for our sample respondent Jane. If your divorce is full of contention and disagreement all the way to the end, there will be 2 of these to submit – the preliminary and the final.

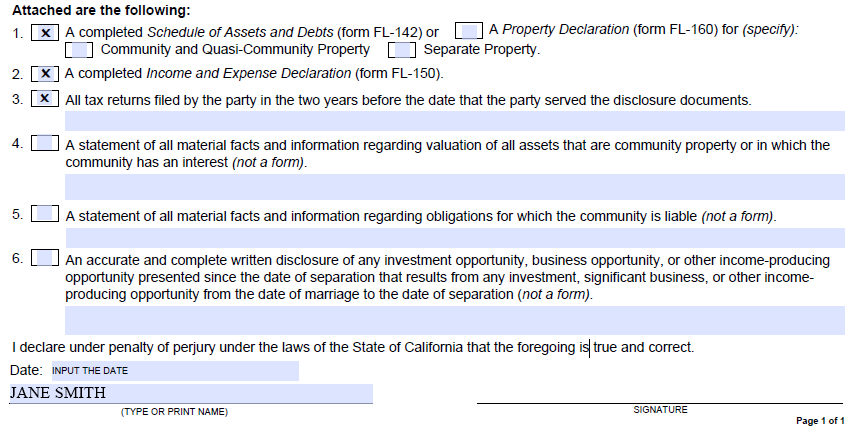

FL-140: Required Documents

1: Schedule of Assets & Debts

You’ll include your completed Schedule of Assets & Debts (FL-142), so check box 1.

2: Income & Expense Declaration

Also required is your Income & Expense Declaration (FL-150), so check box 2.

3: Income Tax Returns

The third item on this form is your tax returns for the last two years. A common objection we get from clients is, “Well, I don’t have my tax returns.” Unfortunately, there isn’t a valid excuse for this. If you filed taxes via Turbo Tax, they have them saved and you can print them out. If you went to H&R Block, call them or log onto their site. If you did your own taxes, you can contact the IRS and they will send you tax transcripts. If your spouse did your taxes for you and they’re in possession of your return, it’s not a problem – contact the IRS. The point is that you can obtain your return, so don’t avoid this step because they’re not on hand.

4-6: Personal Statements

Items 4-6 are more abstract and less cut and dry. The statements they are asking for are customized by you. The form is asking for declarations that cover these 3 areas, and the gist of your declarations should summarize something like, “I don’t have any further information regarding the valuation of the assets, other than what I’ve already provided, and I have disclosed all material facts and information regarding the obligations that we might be liable for, and I’m saying that I’ve disclosed everything I have known about and I don’t know any other opportunities or investments or anything else that is involved.”

Sign, Date, and Serve

You do not file this document with the court, and that includes your tax returns and the other documents. Aside from the first two items on this form (FL-142 and FL-150), the other items you want to attach to this are your tax returns, and your statements that cover numbers 4-6.

If you have any questions, please feel free to give us a call: 925-215-1388, or you can email me.

DIY Divorce Video Series

You're on the Respondent with Children specialized track. Change your course or learn more about all of the court forms involved in a California divorce at our DIY Divorce Center. (scroll to dismiss this notice)