Respondent with Children

California Divorce Form FL-142

FL-142 details everything you owe and own.

Form FL-142 is also known as the Schedule of Assets and Debts, and it’s not as difficult to complete as the Income and Expense Declaration. However, many tend to get confused with the attachments. FL-142 is your opportunity to disclose everything that you own and everything that you owe, and you must provide documentation attached with it. If you tend to be unorganized when it comes to paperwork associated with your assets and debts, it may take a while to complete.

First, we’ll have a brief review of your forms known as the, “financial disclosures,” which consist of 4 parts:

- FL-140: Declaration of Disclosure

- FL-141: Declaration Regarding Service of Declaration of Disclosure and Income & Expense Declaration

- FL-142: Schedule of Assets & Debts

- FL-150: Income & Expense Declaration

We typically refer to the above items as the, “Preliminary Declarations of Disclosure,” or, “PDD’s.” In general, it’s a full disclosure of everything you own, owe, earn, and spend.

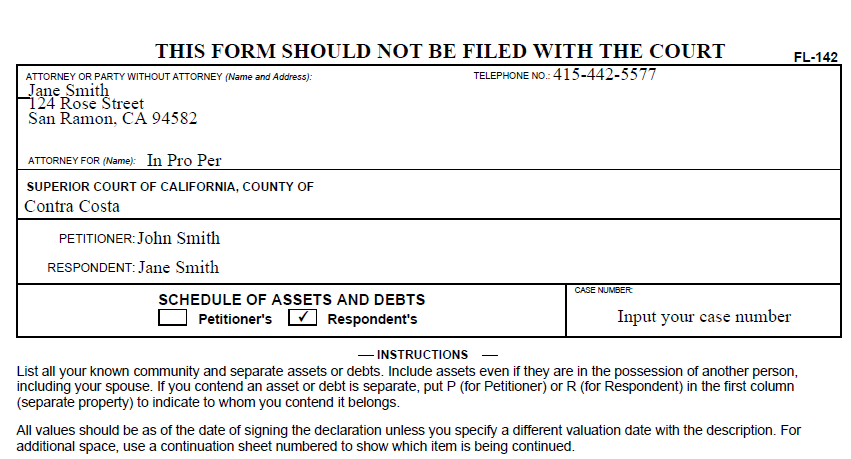

FL-142: Contact and Court Information

Notice the instructions at the top of this form – it should not be filed with the court. The main reason behind this is because divorce is a public filing. If this form was filed with the court, anyone can access the information and your personal financial details.

Starting at the top with your contact info, it’s the same thing you’ve completed many times before with the other forms. Due to the fact that you’re not filing this form with the court, you don’t need to include court’s address. However, it’s important to include your case number which is mandatory regardless of your title as petitioner or respondent. Next, check the appropriate box associated with your title, either petitioner or respondent. Sticking with our sample respondent Jane, her info appears in the example above.

Assets

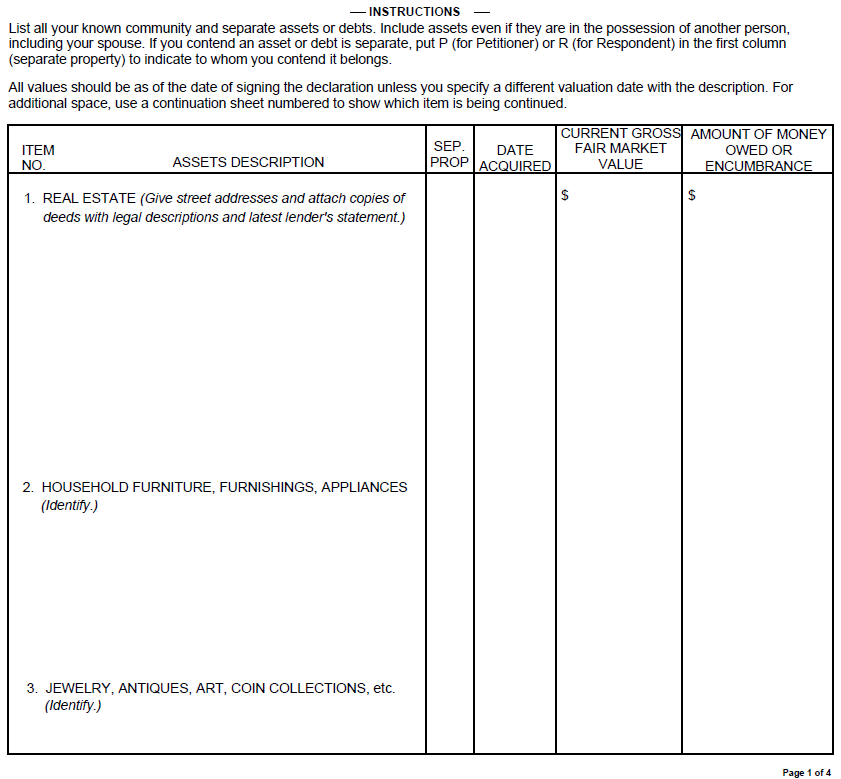

FL-142: 1, 2, 3 – Assets

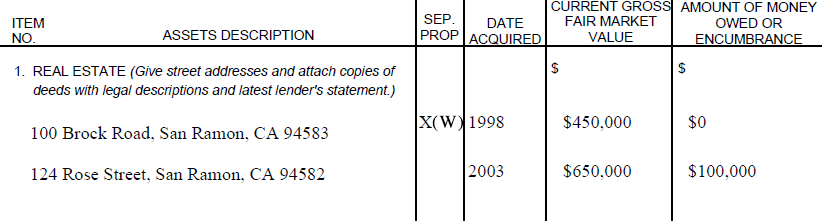

1: Real Estate

FL-142: 1 – Real Estate

The first thing you’re going to tackle is real estate. So in Jane’s case, she and John have the community house, meaning house they bought together, and she also owns the house that she purchased prior to the marriage. Jane would include the addresses of each home. Input your real estate assets. If it’s separate property, you’d check the box, “separate property,” and you’d input, “P” for petitioner, “H” for husband, or “W” for wife. If you don’t remember exact dates for the “Date Acquired” section, it’s not a huge issue. You can input, “pre-marriage,” “during marriage,” or “post-separation.” You should be able to remember those timelines at a minimum, even if you don’t remember the year, month or day.

Current gross fair market value: for real estate, you have a few different ways of obtaining the current gross fair market value. We like to use Zillow, and remember that it’s only an estimate. You’re not required to order an appraisal. Other means of finding the estimated value is with a property tax assessment, a recent refinance, or if you had a recent appraisal done on the home.

Amount of money owed or encumbrance: you can obtain this from your mortgage statement.

FL-142: Real Estate Statements

Italicized items in parentheses: these are all documents that you’ll want to track down and attach to this form. In the real estate category, it’s asking for a copy of the deed and mortgage statement. You’re going to be making an estimate of the gross fair market value, so attach a print out of the zillow report or whatever you’re using to substantiate the current gross fair market value.

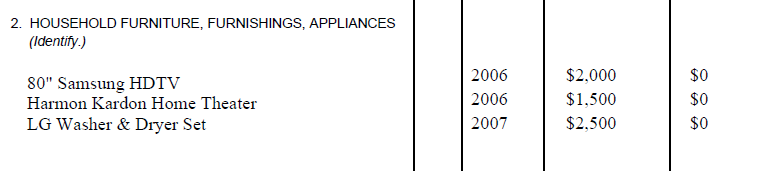

2: Furniture, Furnishings, & Appliances

FL-142: 2 – Furniture, Furnishings, & Appliances

3: Jewelry, Antiques, Art, etc

FL-142: 3 – Jewelry, Antiques, Art, etc

If you feel that you’re going to fight over items in these categories, it’s recommended to list the big ticket high value items. Specific things such as TV’s, video game systems, or anything else you anticipate conflict over should be included here. On the other hand, if you have a fairly amicable divorce and you and your spouse are on good terms, you can input, “usual and customary.” Fair market value when it comes to these items can be thought of as what the item could sell for on Craigslist or Ebay.

Page 2

FL-142: 4,5,6,7 – More Assets

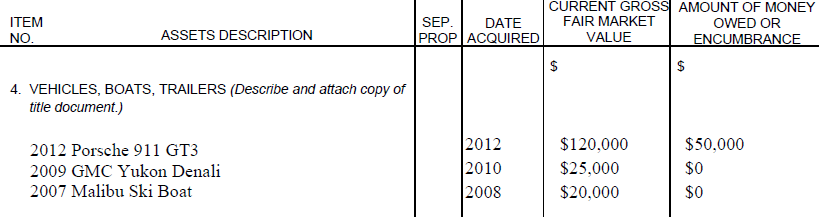

4: Vehicles, Boats, Trailers

FL-142: 4 – Vehicles, Boats, Trailers

Next, we have vehicles. It’s recommended to be very specific when it comes to your vehicles, including year, make, and model. It’s asking for you to describe each and attach a copy of the title document (also known as the pink slip). If you don’t have a pink slip because you’ll still paying on a loan, you’ll need to attach a statement of the current loan balance from the lender. You’ll also want to figure out what the current gross fair market value is. We typically use Kelley Blue Book, kbb.com, to obtain the gross fair market value.

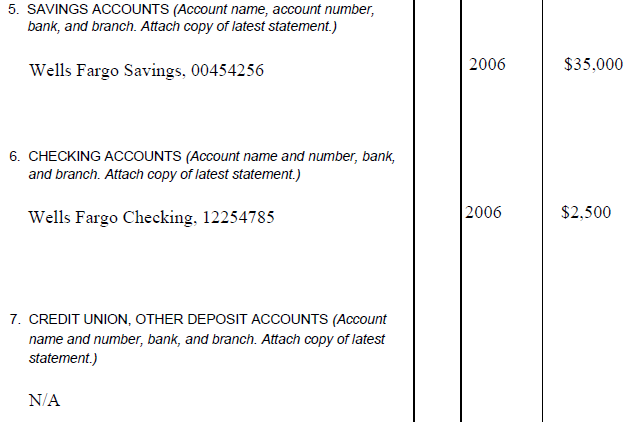

5-7: Bank Accounts

FL-142: 5, 6, 7 – Bank Accounts

Numbers 5-7 refer to bank accounts in general, and we have no idea why the form breaks it up into multiple categories. As far as attachments, you’ll want to attach all of your recent statements. We advise clients to submit date of separation statements because in dealing with community and separate property, we need to know what the values were at the date of separation. Let’s assume in Jane’s case, they separated January 2014, and they don’t get around to completing this form until October 2014. A lot of times, it’s very helpful to submit both a date of separation statement and a current statement. This way, you have an idea of what the community amount was at the time of separation, and what’s going on right now in the post-separation period.

8-10: Cash, Tax Refund, Life Insurance

FL-142: 8, 9, 10 – Cash, Tax Refund, Life Insurance

When it comes to cash, most input, “on hand,” “in pocket,” “in wallet,” etc, unless you have a large amount of cash stashed somewhere. Tax refund, if applicable, would include the year, and whether it’s federal or state. Some examples could include, “2013 federal,” “2013 state,” and you’d put the amounts. For the life insurance category, you can take a look at your policy to determine if it has cash surrender value. For most people, the life insurance policies they have through their employers do not have cash surrender value.

Page 3

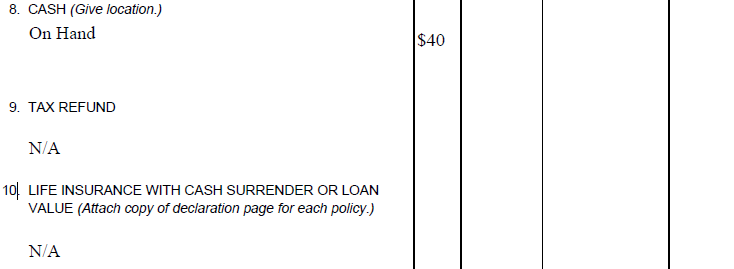

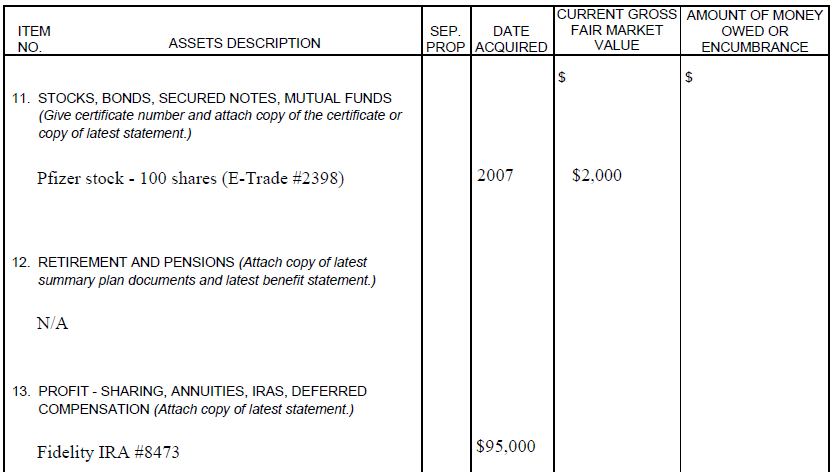

11-13: Investments & Retirement Assets

FL-142: 11, 12, 13 – Investments & Retirement Assets

The next page covers investments and retirement assets. Stocks, bonds, mutual funds typically are held with larger organizations you may have heard of, such as Fidelity, TD Ameritrade, or E-trade. If you think you might have accounts in this category, you’ll need to go through your filing cabinet and dig around.

The same process covers retirement and pensions, profit sharing, annuities, IRA’s, taking you through 13. For any accounts, remember that you’ll need to include statements. We mentioned that this form requires a lot of work and time. We recommend to start early while you’re in the initial divorce process, and if you are amicable with your spouse, tackle it together.

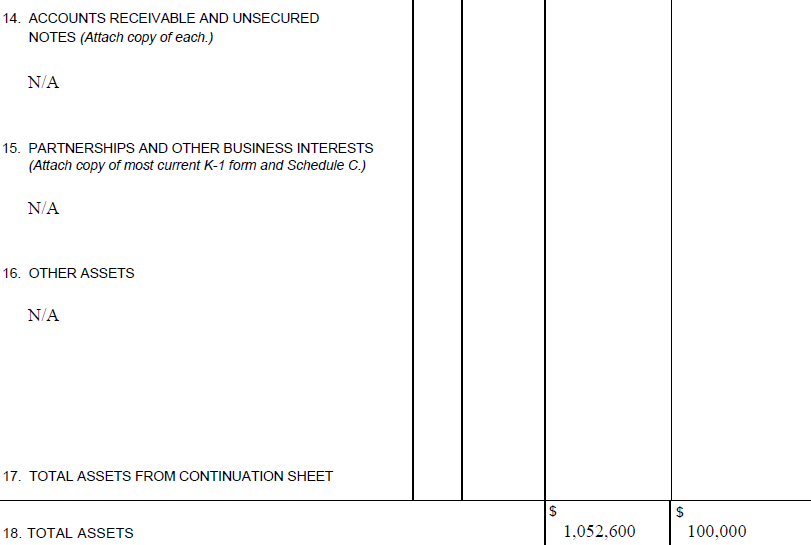

14-18: Business & Other Assets

FL-142: 14, 15, 16, 17, 18 – Business & Other Assets

If you own a business, you have to fill out this information. If you don’t, you can put, “N/A.” If something doesn’t apply to you, and you don’t have that asset, it’s recommended to input, “none,” or “doesn’t exist,” or “N/A.” This informs the reader that nothing was skipped over unintentionally. In general, if you have a hunch that there exists an account or multiple accounts, but can’t find specifics, put any information that you know. It could be something as simple as, “Wife’s IRA account.” This is important because it helps to keep track, and it also lets your spouse know that you’re aware of it as well.

The “Other Assets” section covers items that don’t fit anywhere else. Usually this is one of a kind, very expensive stuff such as a $10,000 road bicycle. Finally at the bottom for 18, add up your totals for the 2 columns associated with fair market value and amounts owed.

Page 4

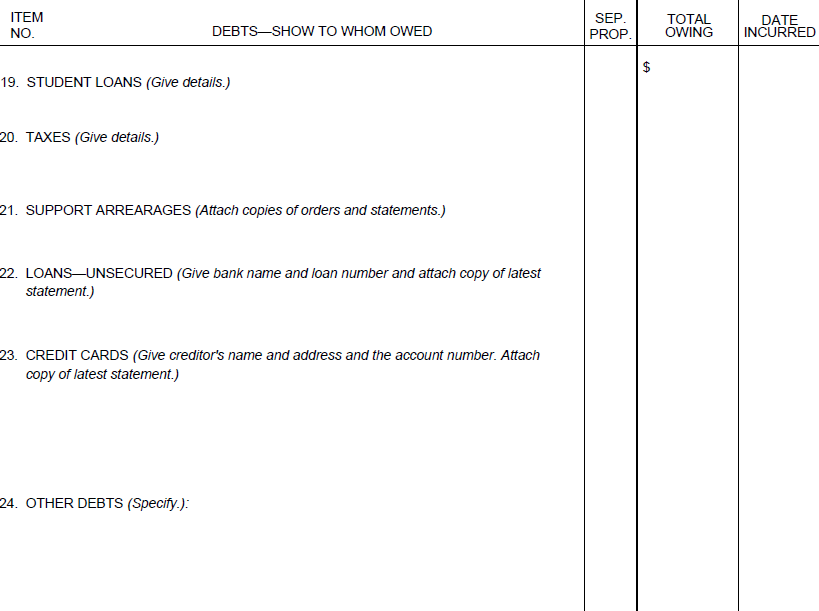

The final page deals with debts. Everything that you owe, whether it’s your name, your spouse’s name, or both of your names is needed here.

19-24: Student Loans, Taxes, Support, Credit Cards

FL-142: 19-24 – Student Loans, Taxes, Support, Credit Cards and other debts

On this page, the debts begin with student loans. You’d input Sallie Mae or the current lender along with the amount you owe, and the date the loans were originally disbursed to your school. Again, if you don’t know the exact date or year, it’s fine to input “before marriage,” “during marriage,’ or “post-separation.”

The next section deals with taxes. Include specifics in terms of what taxes you owe, including state and federal, along with amount and year.

Support arrearages deal with formal child or spousal support obligations that you owe and have not been paying. This turns that money into a debt.

Unsecured loans would be money borrowed without property as collateral. If you borrowed $10,000 from your mother and didn’t give her anything in exchange, it would fall under this category.

Credit cards are next, and you want to list all of them. A popular question is,”Well, I pay off the balances every month, do I have to fill it out?” The answer is, “Yes,” and again, for 2 reasons. First, it’s a way to start cleaning up your credit. A lot of spouses have joint credit cards or credit cards in general that they’ve forgotten about. So even if it has a zero balance and you haven’t used it in 2 years, you want to list it. If nothing else, for a mental reminder – “I need to go back and do this.”

Other debts category: if you have other specific debts that don’t fit anywhere else, you want to include it here. Remember to sign and date the bottom.

For your average household, you’re probably looking at anywhere from a half inch to a 1 inch thick stack of paperwork that makes up your Schedule of Assets and Debts. In the end, it shouldn’t be just the 4 pages that make up this form. It’s extremely important that you spend the time to do this form right, not because a judge is going to punish you, but because this is setting the tone for your future.

We realize it’s overwhelming and a lot of work, but take the time to do it correctly the first attempt. One last tip – this form and its attachments are served on your spouse, so redact or white out your account numbers, especially any attachments with your social security number. I know you’re going to protect your information, but you can’t necessarily trust your spouse to protect your information, and if this document goes in the trash or left somewhere, you always have to worry about identity theft. As always, please reach out to us if you have questions or hit an obstacle with this form.

DIY Divorce Video Series

You're on the Respondent with Children specialized track. Change your course or learn more about all of the court forms involved in a California divorce at our DIY Divorce Center. (scroll to dismiss this notice)