Respondent without Children

California Divorce Form FL-120

As the respondent, file and serve this form within 30 days of receiving FL-100 and 110.

In this article, we’re going to discuss the form sometimes referred to as “the response,” officially titled FL-120. The information covered below will be beneficial regardless of your position in the divorce case, whether you are the respondent and have been served with the divorce papers, or the petitioner seeking to understand what your spouse needs to do in order to complete this form.

Up through this point in our series, we’ve been using the hypothetical Smith couple as the example to complete each form. John is the petitioner, and his wife Jane, the respondent, is going to be completing and filing this form with the court. The assumption when completing these forms is that both parties are representing themselves through their case and do not have an attorney.

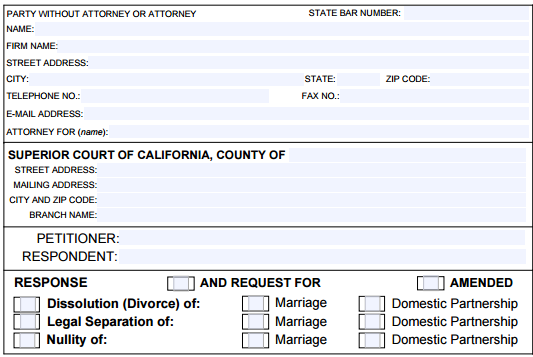

Contact & Court Information

FL-120: Contact and Court Information

As the respondent, Jane would input her name at the top and we’re going to assume that John and Jane are still living in the same house. Her address is 124 Rose Street, San Ramon, California, 94582. Her phone number is 415.442.5566. In Contra Costa county, you’re not required to input a fax number or an email address, so these two fields are optional.

FL-120: Contact and Court Information filled

Attorney For: In Pro Per

Court information: County of Contra Costa, and the street address is 751 Pine Street. The mailing address is PO Box 911, with city and zip Martinez, 94553.

Branch Name: Not a required field, but the name is Peter L. Spinetta Family Law Center. They have this name in large letters outside of the courthouse, so it’s easy to find.

Petitioner and Respondent: If you’re completing this form, you’re the respondent and your spouse is the petitioner. Remember, with California being a no-fault state, it doesn’t matter if you’re the petitioner or respondent – they’re simply titles.

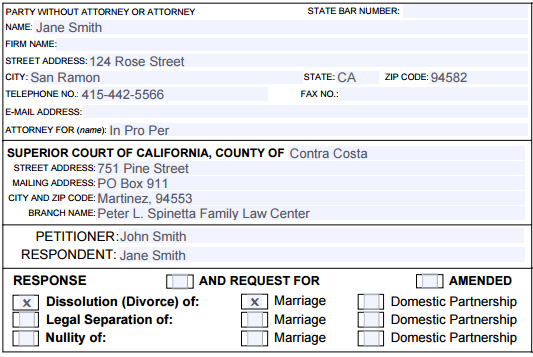

Response

FL-120: Response

A common question is, “Do I have to request a divorce if I don’t want to get divorced?” The answer is “no.” It doesn’t stop the divorce, and is simply a statement whether or not you agree with it. The important thing is you preserve your legal rights by filing this response. Check the box for “Dissolution (Divorce) of:,” along with the box for, “Marriage.” Note that dissolution is a fancy term for “divorce.”

Case number: Your case number is going to be the same as what is listed on the petition, in the same area on both forms. You have the same case number as your spouse and that’s the same case number that you’re assigned for the life of your case.

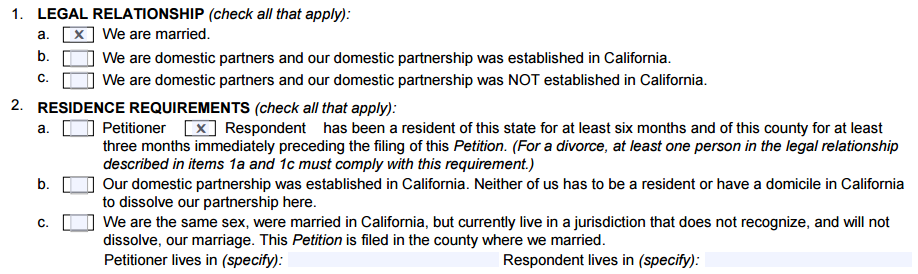

1: Relationship and 2: Residency

FL-120: 1 – Relationship and 2 – Residency

As the respondent, you are going to be asked very similar questions to what was asked of the petitioner in the petition. The reasoning behind this is so you have an opportunity to document your side of the story, and whether you agree or disagree with what is stated in the petition.

Legal Relationship: Jane and John have been married, so she is going to check the box “1a.”

2: Residence Requirements

In California, jurisdiction is required in order to obtain a divorce. Jurisdiction is the legal term for “authority,” or “ability,” so the court needs to have jurisdiction or the ability to hear your case. In your case, it means one of the parties has to be in California for at least 6 months (physically in California), and a resident of the county you’re filing in for at least 3 months.

With our sample couple, let’s say John lived in Florida, and wanted to file for divorce in California. As long as Jane meets the residency requirement being in California for 6 months and in one county for at least 3 months, he could file for divorce in California. We’re going to assume that Jane has met the above requirement, so we’re going to check the box, “2b.” If you and your spouse both meet this requirement, you could check both boxes. Remember, at least one of you need to meet this requirement, otherwise you don’t qualify for a divorce in California.

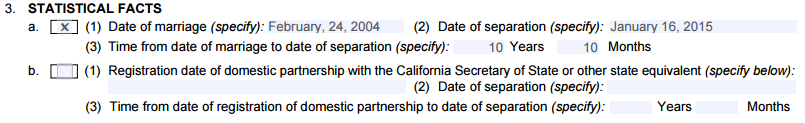

3: Statistical Facts

FL-120: 3 – Statistical Facts

Statistical Facts: Check the box for “3a,” and input the date you were married. It’s common that people forget their marriage date, so don’t feel embarrassed if you have to go back and look at your marriage certificate or ask your parents. Sometimes, your spouse might get it wrong. So this is your chance to correct it and input the actual date of marriage.

Date of Separation:

The next question is going to be the date of separation, which is a very important legal concept. It is the date that you believe the marriage was over. This date is subjective, and tends to be the question where the petition and response do not align. In some cases, it’s clear cut and very specific. But if your date differs from what your spouse placed on the petition, I don’t want you to feel pressured to change your date so they match. It’s important to understand that there are legal consequences to this date. Anything acquired, earned, or incurred after that date of separation is going to be your separate obligation or asset (or your spouse’s separate obligation or asset) depending on who acquired or incurred it. For example, if I am the respondent and I believe the date of separation was today, and my husband won the lottery tomorrow, that would be all his separate property. Likewise, if I won the lottery the day after the date of separation, that would be all my earnings. If the lottery was won during the marriage, it would be considered what we call “community property,” or presumed to be 50/50.

Date of Separation & Length of Marriage:

The other way the date of separation is important is because it determines the length of your marriage. If your marriage is under 10 years, it is presumed to be what we call a “short term marriage.” If it’s over 10 years, we assume that you have what’s considered a “long term marriage.” Long term marriages in California have implications when it comes to spousal support (alimony). If you have any questions regarding the length of your marriage or you’re somewhere in between that 9 to 11 year mark, you probably want to talk to an attorney or do some more research and understand your rights and obligations when it comes down to a long term vs. a short term marriage. Be sure to input the duration of the marriage under “(3).”

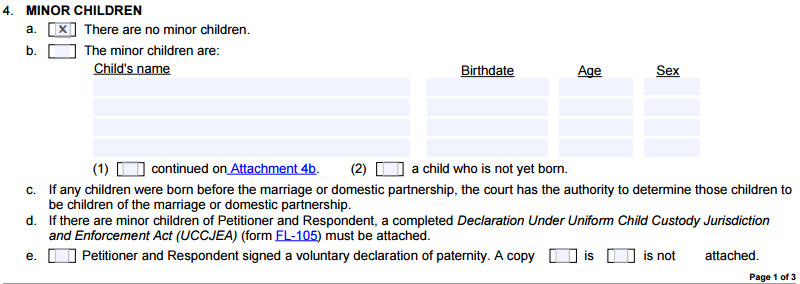

4: Minor Children

FL-120: 4 – Minor Children

Children born before or born (or adopted) during the marriage or domestic partnership fall into this category. In this definition, stepchildren do not count. Children with a different parent involved do not count as a child of the relationship (unless they’re adopted) either. In our sample case there are no minor children so we’re going to check the box, “4a,” and skip the rest of this section.

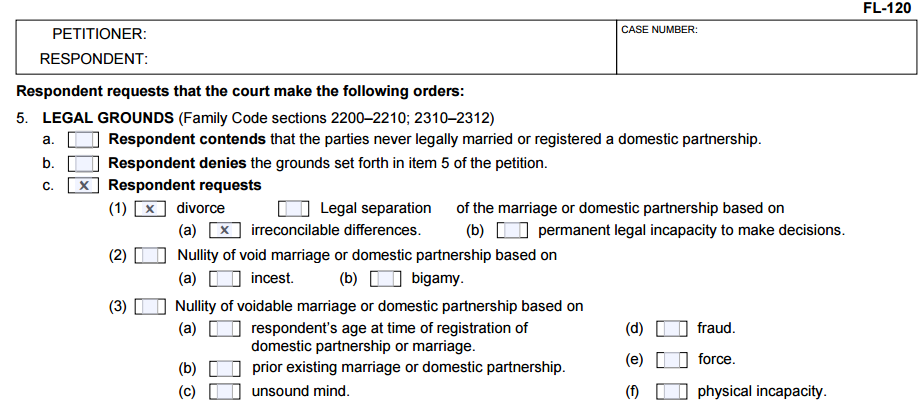

5: Legal Grounds

FL-120: 5 – Legal Grounds

As discussed previously, California is considered “no fault” state, meaning that either one of you can ask for a divorce and the state doesn’t care if you’re the petitioner or the respondent. California also doesn’t really care why you’re getting a divorce. The cause behind the divorce doesn’t have an impact on the assets or debts, and sometimes a divorce ends up fair, and sometimes it ends unfair. But either way, California as a state has adopted a policy that it doesn’t want to deal with the reasons for the divorce. As a result, we generically term the ultimate reason as, “irreconcilable differences.”

The only other grounds for divorce in California would be the permanent legal incapacity to make decisions. This is one of the major changes that took place with this form. The term previously listed, “incurable insanity,” and we’d receive a number of questions related to this. “Well, I think my spouse is insane. Can I just put that?,” or, “You know, it would be kind of funny. Can I put that my spouse is incurably insane?” In reality, this option is referring to a permanent legal incapacity to make decisions. If your spouse has been diagnosed with Alzheimer’s, or they’ve had a traumatic brain injury that renders them incapable of taking care of themselves or making any kind of decisions, this would be the box to check.

6-7: Child Custody and Visitation & Child Support

Since there are no minor children we will skip sections 6 and 7. If there were, we would be filling these as explained in FL-120 for Respondents with Minor Children.

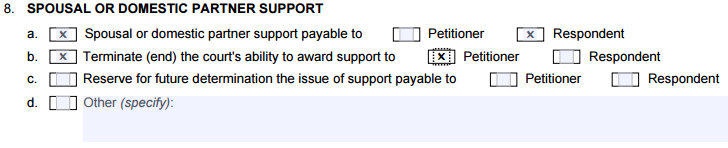

8: Spousal Support

FL-120: 8 – Spousal Support

Spousal support is another term for alimony, or essentially support from one person to the other for maintenance purposes. Child support and spousal support are completely separate, so keep that in mind. Spousal support is considered income, so if you are receiving spousal support, it’s taxable income to you, and whoever is paying spousal support can deduct it on his or her taxes.

In our sample case, let’s assume that Jane wants spousal support from John. She’s going to check the box, “8a,” so she’s asking for spousal support payable to her (the respondent). Check the appropriate box based on your needs. We’ll also assume that Jane doesn’t want to pay spousal support to John, so it’s important to read the boxes carefully. Jane would check “b,” followed by the box for “Petitioner” because doesn’t want to pay support to John. If Jane isn’t certain she wants to receive spousal support, and she’s uncertain if she wants to pay spousal support, she can check box “c” to reserve this subject and keep it pending to revisit in the future.

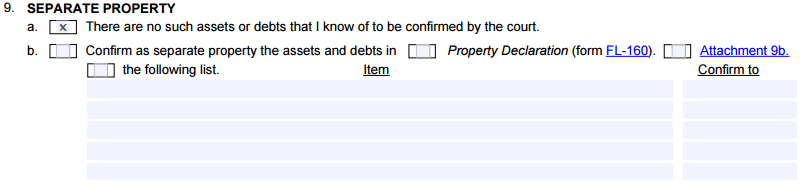

9: Separate Property

FL-120: 9 – Separate Property

The next item is separate property. Separate property is defined as anything acquired before marriage, so in this sample case, before February 24th, 2004, or after separation on January 16th, 2015. For example, Jane wins the lottery on January 17th, 2015, so the winnings are presumed to be her separate property. In this case, we’re going to assume there is no separate property, so we’re just going to check the box, “9a.”

In your particular situation, if you have separate property, you want to list it in “9b.” If you have a car that you purchased before marriage, you want to list it and under “Confirm to,” you’ll input “Respondent.”

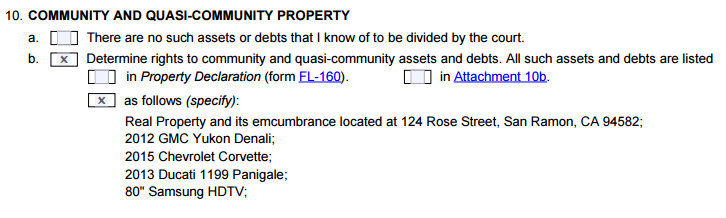

10: Community Property

FL-120: 10 – Community Property

The next issue is community property. Community property is anything acquired during your marriage, so in our sample case, anything acquired February 24th, 2004 until January 16th, 2015. Anything acquired during that time, whether it’s in John’s name or Jane’s name, is presumed to be community property.

We want determine rights to community and quasi community assets and debts, and we’re going to list them follows. It’s recommended to avoid inputting, “to be determined,” or “see attached list at a later date,” or “will be provided later on,” or “unknown at this time.” We don’t advocate this route. We prefer more specificity as it leads to better communication. It paints a clear picture for the court, the judge, yourself, and your spouse. Our recommendation is to list the property. This doesn’t mean that you create a list of 30 pages, and it doesn’t mean you inventory the contents of your entire house and list every pot and pan and piece of linen that you’ve got. In this case, we are going to list the sample family residence, the real property located at 124 Rose Street, city and state, and include, “and its encumbrance” or you could input, “and the mortgage or its debt.” Basically, very few people own a house outright, so we’ll assume that there is a mortgage like most people in America. We’re going to put a semicolon, and we’re going to list the next items which will be vehicles, as most people have vehicles. Most have bank accounts, so you’d include those as well. You’d also list things such as life insurance policies, credit card debt and loans, which are things that also need to be listed because they’ll be divided at some point in time.

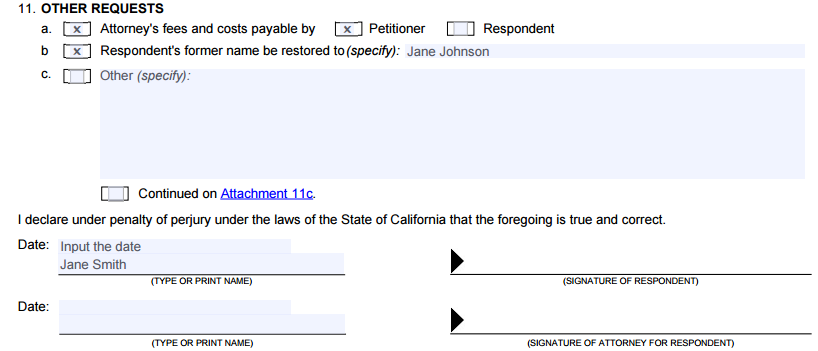

11: Other Requests

FL-120: 11 – Other Requests

In Jane’s case, she wants attorney fees, so let’s check “11a.” Jane wants attorney fees and costs, payable by John, so we check the box “Petitioner.”

Qualification for attorney fees:

There are 2 code sections in California that originate the basis of attorney’s fees. The first would be family code section 2030, which is a need-based award. This covers a scenario with a large gap between each party and their yearly incomes. Your need for attorney fees, and the other party’s ability to pay are examined. The other reason for attorney fees would be family code section 271, which can be categorized as a fine or sanction for bad behavior. Assume your spouse doesn’t show up to court, or shows up to court late. Or, they file frivolous pleadings, or state things that aren’t true. These circumstances are typically what the court would see as “bad,” so the fees would be considered fines or sanctions as a result.

The next item would be 11b, “Respondent’s former name be restored to.” You do not have to restore your maiden name, but you can change your mind at any time in the divorce process. Even after the judgment is entered, you can elect to change your maiden name, or you can choose to hyphenate. Nobody can object to this, so it’s 100% your choice. Assuming Jane wants to restore her former name, she would input, “Jane Johnson.”

Date, print name, and signature: You are the respondent, so you’re going to type (or print) the date and your name on the first line. Input your signature off to the right.

When you’ve been served with the petition and the summons, the summons is going to tell you that you have 30 days to respond. This is the document you need to file and serve within 30 days in order to protect your rights and make sure you’re participating fully in the divorce.

So we’ve just completed your response, which is FL-120, and again, this form applies to the respondent. If you are a respondent with minor children, you’ll want to watch the video on FL-105 to assist with completing your UCCJEA (required if you have minor children of your marriage).

If you don’t have any minor children of your marriage, you can stop with the FL- 120. You may find it very helpful to go and watch the videos on the other series for the petitioner, which would be

- The Petition, FL-100,

- The Summons, FL-110,

- The Proof of Service of Summons, FL-115,

- The Notice and Acknowledgement of Receipt, FL-117

Next in our series are going to be covering forms that everybody fills out, whether you’re the petitioner or respondent, termed your financial disclosures. They’re comprised of 4 different documents:

- Income and Expense Declaration, FL-150,

- Schedule of Assets and Debts, FL-142,

- Declaration of Disclosure, FL-140,

- Declaration regarding Service of Declaration of Disclosure and Income and Expense Declaration, FL-141

You may have noticed that these are listed out of numerical order, and that’s very intentional. The video series is set with the intention of covering the most difficult forms first (FL-150 and FL-142), and then wrapping up with the easier forms, which are FL-140 and FL-141.

DIY Divorce Video Series

You're on the Respondent without Children specialized track. Change your course or learn more about all of the court forms involved in a California divorce at our DIY Divorce Center. (scroll to dismiss this notice)